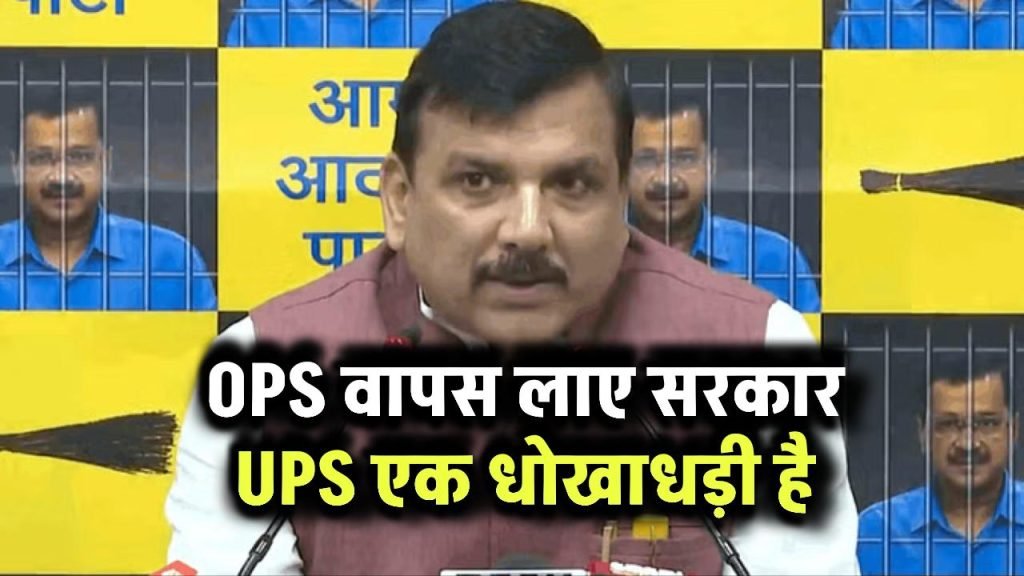

Unified Pension Scheme: In recent political discourse, Aam Aadmi Party (AAP) leader Sanjay Singh has launched a fierce critique of the newly implemented Unified Pension Scheme (UPS). Singh has drawn parallels between the UPS and the Old Pension Scheme (OPS), asserting that the new system is a mere façade and lacks the benefits offered by its predecessor. This article delves into Singh’s arguments, the implications of the UPS, and the broader context of pension reforms in India.

Understanding the Unified Pension Scheme

The Unified Pension Scheme was introduced as a part of the government’s effort to streamline pension disbursement across various sectors. The UPS aims to consolidate multiple pension schemes into a single, more manageable framework.

Objectives of the Unified Pension Scheme

- Simplification: By unifying various schemes, the government aims to make pension management easier for both beneficiaries and administrative bodies.

- Transparency: The UPS intends to offer greater transparency in how pensions are calculated and distributed.

- Equity: It aims to provide equal benefits to all pensioners, regardless of their previous employment sectors.

Despite these noble intentions, critics like Singh argue that the scheme falls short in practical implementation.

Sanjay Singh’s Critique: Key Arguments

Sanjay Singh’s arguments against the UPS center around the following points:

1. Lack of Adequate Benefits

Singh argues that the UPS does not provide the same level of financial security that the OPS did. He highlights that many employees who have transitioned to the UPS are finding their pensions inadequate to meet their living expenses.

- Comparison of Benefits: According to Singh, while the OPS offered a defined benefit based on the last drawn salary, the UPS relies on a contributory model that does not guarantee similar outcomes.

- Increased Financial Strain: Singh posits that many retirees under the UPS are struggling financially, leading to increased stress and a lower quality of life.

2. Ambiguity in Implementation

Another critical point raised by Singh is the lack of clarity in the implementation of the UPS. He asserts that the guidelines and processes surrounding the scheme are vague, leading to confusion among potential beneficiaries.

- Complicated Procedures: Singh argues that the application and approval processes for pensions under the UPS are cumbersome and bureaucratic.

- Delayed Disbursement: Reports of delayed pension payments have surfaced, causing distress among retirees who rely on timely payments for their day-to-day expenses.

3. Call to Reinstate the OPS

Singh has been vocal in demanding the reinstatement of the OPS, which he believes is a more equitable and beneficial system for pensioners. He argues that the government should consider the overwhelming sentiment among retirees who long for the security and simplicity of the OPS.

- Public Sentiment: Singh cites various surveys and public forums where citizens have expressed dissatisfaction with the UPS.

- Political Responsibility: He calls on the government to take responsibility and listen to the voices of those affected, rather than imposing a system that many view as inadequate.

The Political Context: Pension Reforms in India

The debate around the Unified Pension Scheme is not occurring in isolation; it is part of a broader discussion about pension reforms in India. Over the years, pension schemes have undergone significant changes, often driven by economic factors and shifting demographic trends.

Historical Background of Pension Schemes in India

- Old Pension Scheme (OPS): The OPS provided guaranteed pensions based on the last drawn salary, offering financial security for retirees. However, it was often criticized for being unsustainable in the long run.

- Shift to New Pension Scheme (NPS): In response to concerns about the sustainability of the OPS, the government introduced the NPS, which operates on a defined contribution basis. While it offers some flexibility and potential for higher returns, it also comes with risks for beneficiaries.

Challenges in Pension Reform

Pension reform in India has faced several challenges, including:

- Political Resistance: Changes to pension schemes often encounter resistance from various political factions, each representing different interests.

- Public Confusion: Many citizens are unaware of the specifics of the new schemes, leading to anxiety and dissatisfaction.

- Economic Pressures: The need for sustainable pension systems must be balanced with the economic realities facing the government.

The Reactions: Public and Political Response

Sanjay Singh’s statements regarding the UPS have elicited a range of reactions from the public and political figures.

1. Public Sentiment

Many retirees have expressed support for Singh’s critique, arguing that the new pension scheme does not meet their needs.

- Personal Stories: Numerous retirees have shared personal anecdotes about their struggles with the new system, echoing Singh’s concerns.

- Grassroots Movements: Various organizations and forums have emerged, advocating for the return of the OPS and mobilizing public opinion against the UPS.

2. Political Backlash

The government has responded to Singh’s criticism by defending the UPS and highlighting its potential benefits.

- Official Statements: Government officials have asserted that the UPS is a step toward modernization and efficiency in pension management.

- Counterarguments: Supporters of the UPS argue that the scheme is designed to cater to a changing demographic and economic landscape.

The Way Forward: Balancing Reform with Equity

As the debate surrounding the UPS continues, it is essential to find a balanced approach that addresses the needs of retirees while ensuring the sustainability of pension systems.

1. Reviewing the Unified Pension Scheme

There is a pressing need for the government to review the UPS, taking into consideration the feedback from beneficiaries and experts.

- Stakeholder Engagement: Engaging with retirees and pension experts can help refine the scheme to make it more beneficial.

- Transparent Processes: Simplifying application processes and ensuring timely disbursements should be a priority.

2. Public Awareness Campaigns

Increased awareness about the details of the UPS is essential to mitigate confusion among potential beneficiaries.

- Information Dissemination: The government should conduct public awareness campaigns to inform citizens about their rights and entitlements under the UPS.

- Feedback Mechanisms: Establishing channels for beneficiaries to voice their concerns can lead to improvements in the system.

Conclusion: A Call for Dialogue and Reassessment

Sanjay Singh’s critique of the Unified Pension Scheme highlights the need for ongoing dialogue regarding pension reforms in India. The concerns raised about the adequacy, clarity, and effectiveness of the UPS are valid and warrant serious consideration.

As the government navigates the complexities of pension reform, it must strive to balance the need for sustainable systems with the imperative to provide equitable support to retirees. The voices of citizens, especially those most affected by these changes, should guide the decision-making process.

Ultimately, pension reform is not just a financial issue; it is about ensuring the dignity and security of the individuals who have contributed to the nation’s growth. In light of this, the government should take heed of the public sentiment and consider reinstating the OPS if it proves to be the more beneficial option for pensioners.

Moving forward, fostering an environment of transparency, engagement, and responsiveness will be crucial in building a pension system that serves all citizens effectively. The future of pension reforms in India should prioritize the needs and rights of retirees, ensuring that they receive the support they deserve.

Hello friends, my name is Nitesh Kumar, I work as a news writer and I have also done journalism in which I have learned news writing and reporting, I publish current date Breaking news in it and If you want to contact me you can mail me at Help@Sabhikhabre.com